PCI DSS QSA Audit & Assessment Services from Lazarus Alliance. Call +1 (888) 896-7580 today.

Table of Contents

Toggle

PCI DSS Compliance Made Simple – Certified QSA Audits & SAQ Assistance

If your business accepts, processes, stores, or transmits credit card data, you are required to demonstrate annual compliance with the Payment Card Industry Data Security Standard (PCI DSS). Depending on your transaction volume and payment environment, this may involve completing a Self-Assessment Questionnaire (SAQ) or undergoing a full Report on Compliance (ROC) prepared by a PCI DSS Qualified Security Assessor (QSA).

Lazarus Alliance is an officially accredited PCI DSS Security Standards Council Qualified Security Assessor (QSA) company, certified and regularly audited by the PCI Security Standards Council (PCI SSC). This designation means we are authorized to validate your organization’s compliance and issue the official documentation that your acquiring bank, payment brands (Visa, Mastercard, AmEx, Discover, JCB), and partners require.

Payment Card Industry Data Security Standard (PCI DSS)

Whether you’re a small e-commerce merchant completing SAQ A or a large enterprise requiring a Level 1 on-site assessment, we deliver scalable, efficient, and stress-free PCI DSS compliance solutions tailored to your exact environment.

Why organizations choose Lazarus Alliance as their PCI QSA:

- Over 20 years of payment security and compliance experience

- Fixed-price engagements with no surprise fees

- Same-week scoping and rapid scheduling (often within 7–14 days)

- Dedicated QSA teams that speak plain English—no unnecessary jargon

- Expertise across all SAQ types (A, A-EP, B, B-IP, C, C-VT, D, P2PE) and Level 1 ROC assessments

- Full support for merchants, service providers, and third-party processors

- Proactive remediation guidance so you achieve (and maintain) compliance faster

- Nationwide and international coverage with remote + on-site options

Ready to get compliant without the headaches? Contact our QSA team today for a free scoping call and transparent quote. — Michael Peters, CEO & Founder

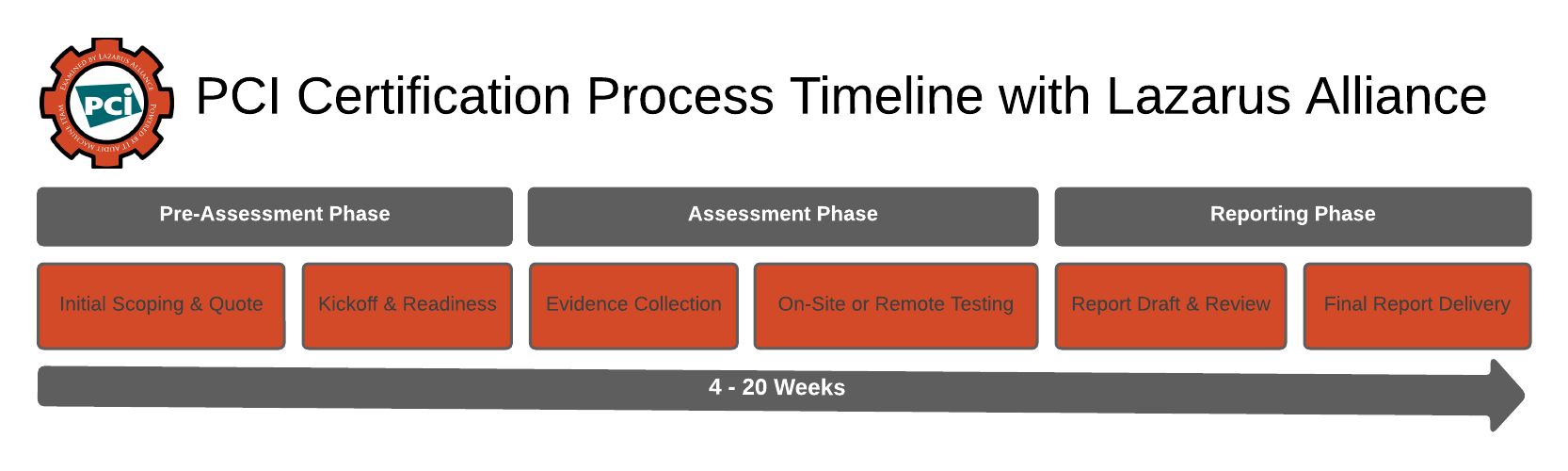

Basic PCI DSS Audit Timeline – What to Expect with Lazarus Alliance

Here’s a clear, realistic timeline for a typical PCI DSS Lazarus Alliance-led assessment (Level 1 ROC or validated SAQ). Timelines can be shortened significantly with good preparation and availability.

| Phase | Activities | Duration | Who’s Involved |

|---|---|---|---|

| 1. Initial Scoping & Quote | • Free scoping call • Review of card data flows (CDE diagram) • Determine SAQ type or Level 1 ROC • Fixed-price proposal issued | 1–5 business days | You + Lazarus Alliance QSA |

| 2. Kickoff & Readiness | • Formal kickoff meeting • Evidence request list sent • Optional gap/remediation workshop • Access to secure client portal | 3–10 days | You + Lazarus Alliance QSA + your IT/team |

| 3. Evidence Collection | • You upload policies, screenshots, logs, configs, etc. • We perform remote interviews and system reviews | 2–6 weeks | Primarily, you (we guide you) |

| 4. On-Site or Remote Testing (Level 1 only) | • 2–5 days of on-site or fully remote validation testing • Sampling of controls, vulnerability scans review, penetration test review | 3–10 days | Lazarus Alliance QSA team + your staff |

| 5. Remediation (if needed) | • We identify gaps and provide prioritized fix recommendations • You correct items • Re-test evidence submitted | 2–12 weeks | You (we advise and re-validate) |

| 6. Report Draft & Review | • Draft Report on Compliance (ROC) or Attestation of Compliance (AOC) delivered for your review | 1–2 weeks | Lazarus Alliance QSA prepares; you review |

| 7. Final Report Delivery | • Final signed ROC/AOC + SAQ (if applicable) delivered • Ready to submit to your acquirer/payment brands | 3–7 days | Lazarus Alliance |

| 8. Ongoing Support | • Help submitting to banks • Priority support until approved • Free post-assessment call | Ongoing | Lazarus Alliance |

Typical Total Duration

| Merchant Type | Fastest Possible | Average | With Major Gaps |

|---|---|---|---|

| SAQ A, A-EP, B-IP, C (validated) | 4–8 weeks | 8–12 weeks | 12–20 weeks |

| Full Level 1 ROC (on-site/remote) | 10–14 weeks | 14–20 weeks | 20–30 weeks |

How to Hit the “Fastest Possible” Timeline

- Have network diagrams and data-flow diagrams ready before kickoff

- Complete your SAQ in advance (we’ll validate it)

- Use an Approved Scanning Vendor (ASV) that’s already passing quarterly scans

- Grant portal access and schedule interviews quickly

Frequently Asked Questions

What is a PCI DSS Audit?

A PCI DSS Audit is an evaluation to ensure that organizations that process, store, or transmit credit card data comply with the Payment Card Industry Data Security Standard (PCI DSS). It assesses security management, policies, network architecture, software design, and cybersecurity measures to protect sensitive payment information and prevent data breaches.

Why do organizations need a PCI DSS Audit?

Organizations handling credit card information—such as merchants, service providers, and acquirers—require PCI DSS compliance to avoid severe penalties, reputational damage, and operational disruptions from breaches. Non-compliance can invalidate certifications and expose businesses to legal risks, making regular audits essential for all merchant levels (1-4).

What services does Lazarus Alliance provide for PCI DSS compliance?

Lazarus Alliance, a PCI SSC-approved Qualified Security Assessor (QSA), offers comprehensive PCI DSS audits, including readiness assessments, Reports on Compliance (ROC), Self-Assessment Questionnaires (SAQ) support, penetration testing, vulnerability scanning, and Cybervisor consulting. They use scalable solutions and proprietary tools like the IT Audit Machine (ITAM) for efficient, collaborative assessments.

How does the PCI DSS Audit process work with Lazarus Alliance?

The process begins with a baseline assessment over a few weeks, tailored to your schedule. It follows a proven methodology with a project plan to ensure on-time, on-budget compliance. Lazarus Alliance employs a continuous audit approach via its Proactive Cyber Security™ methodology, providing 24/7 access to secure portals for ongoing collaboration and gap resolution.

What are the benefits of choosing Lazarus Alliance for PCI DSS Audits?

Clients experience an average 46% reduction in assessment time through tools like the Continuum GRC ITAM SaaS portal. Their proactive, year-round approach prevents compliance threats, reduces costs by avoiding scope creep, and delivers objective evaluations to safeguard your reputation. It fosters sustainable partnerships focused on integrity and reliability, suitable for organizations of all sizes.

What is the Proactive Cyber Security™ methodology?

Unlike traditional end-of-period audits, Proactive Cyber Security™ is a continuous compliance strategy that identifies and addresses gaps throughout the year. It integrates proprietary technology for real-time monitoring, penetration testing, and vulnerability management, helping organizations maintain valid certifications without last-minute rushes.

Which merchant levels does Lazarus Alliance serve?

Lazarus Alliance supports all PCI DSS merchant levels (1 through 4), including high-volume merchants (Level 1) and smaller businesses (Level 4). Their scalable services ensure tailored audits for any organization processing payment card data, regardless of size or transaction volume.

How can I contact Lazarus Alliance to start a PCI DSS Audit?

Reach out via phone at +1 (888) 896-7580 to discuss your needs, request a quote, or schedule an initial consultation. Their team can guide you through readiness assessments and custom compliance plans.

Or, use the intake form below for prompt attention from our team.

Credentials You Can Count On

PCI Security Standards Council Qualified Security Assessor (QSA) company.

Talk with one of our experts

Our Lazarus Alliance Cybervisor™ teams have experience performing thousands of assessments for organisations providing services to clients around the world.

We're here to answer any questions you may have.

Real-World Benefits of Achieving and Maintaining PCI DSS Compliance (Validated by a Lazarus Alliance QSA)

| # | Benefit | Why It Matters to Your Business |

|---|---|---|

| 1 | Avoid massive fines | Payment brands (Visa, Mastercard, etc.) can fine acquirers $5,000–$100,000 per month for non-compliance. Those fines almost always get passed directly to the non-compliant merchant. |

| 2 | Keep your ability to accept credit cards | Serious or repeated non-compliance can result in your merchant account being terminated. No cards = immediate revenue loss. |

| 3 | Dramatically lower breach risk | PCI DSS forces encryption, access controls, vulnerability management, and monitoring—proven to stop 95%+ of card data breaches when fully implemented. |

| 4 | Reduce or eliminate breach liability | If you are fully compliant at the time of a breach and have a validated ROC/AOC from a QSA, most card brands waive forensic investigation fees and many liability assessments. |

| 5 | Meet contractual & partner requirements | Franchisors, marketplaces (Amazon, Stripe, Shopify Plus), payment gateways, and large customers frequently require proof of PCI compliance (validated ROC or SAQ) before onboarding or renewal. |

| 6 | Simplify vendor & customer due diligence questionnaires | Instead of filling out 100-page security questionnaires, you just attach your Attestation of Compliance (AOC) and latest ASV scan—saves weeks of sales-cycle time. |

| 7 | Protect your brand and customer trust | “We are Lazarus Alliance PCI DSS certified” is a powerful marketing message. A public breach with card data almost always destroys reputation and customer loyalty. |

| 8 | Lower cyber-insurance premiums | Most cyber policies now give 10–30% discounts (or even approve coverage at all) when you have current, Lazarus Alliance QSA-validated PCI DSS compliance. |

| 9 | Streamline future audits & renewals | Once the first assessment is done right, subsequent annual validations are 50–70% faster and cheaper because policies and evidence are already in place. |

| 10 | Competitive advantage | Many RFPs and enterprise contracts explicitly favor (or require) vendors with current Level 1 PCI DSS certification, giving you an edge over non-certified competitors. |

Bottom Line

PCI DSS compliance is not just a check-box exercise—it’s one of the highest-ROI security and business-risk investments most organizations will ever make.

With a validated certification from a reputable QSA like Lazarus Alliance, you turn a regulatory burden into a genuine competitive advantage while sleeping better knowing cardholder data (and your business) is truly protected.