IRS 4812 & FISMA Compliance Audit Services by Lazarus Alliance. Call +1 (888) 896-7580 today!

Table of Contents

Toggle

IRS Publication 4812 (Contractor Security Controls) establishes the minimum security and privacy safeguards that must be implemented by any contractor or subcontractor that receives, processes, stores, accesses, transmits, protects, or otherwise handles Federal Tax Information (FTI) or other IRS information at contractor-owned or contractor-operated facilities.

This requirement applies to:

- Prime contractors awarded an IRS contract

- All subcontractors and tiered subcontractors supporting the primary contract

- Any entity (including cloud service providers, data centers, or third-party vendors) that maintains IRS information outside of IRS-controlled facilities

Contracts of any duration are in scope if FTI is involved; however, contracts lasting 12 months or longer typically trigger the full annual State of Security (SoS) submission and independent audit/validation requirements.

Contractor Security & Privacy Controls (IRS 4812)

Lazarus Alliance delivers industry-leading, cost-effective, and innovative IRS 4812 compliance and audit services through our Proactive Cyber Security® methodology and Cybervisor™ continuous assurance platform.

Unlike traditional “point-in-time” audits that trigger last-minute scrambling, we provide continuous risk intelligence, automated evidence collection, real-time remediation tracking, and always-current compliance visibility. This proactive approach significantly reduces performance risk, operational burden, audit findings, and the potential for costly contract penalties.

Sensitive But Unclassified (SBU) / Federal Tax Information (FTI) under IRS 4812 IRS 4812 designates the following as Sensitive But Unclassified data requiring the highest level of protection:

- Federal Tax Information (FTI) – All returns and return information protected under IRC § 6103, including tax returns, audit files, taxpayer correspondence, collection data, and any information received from or generated on behalf of the IRS.

- Personally Identifiable Information (PII) – Any data that can be used alone or in combination to identify an individual (e.g., name, Social Security Number, date of birth, biometric records, financial account numbers).

- Other Sensitive Information, including:

- IT system configurations, network diagrams, and security settings

- Vulnerability assessments and penetration test results

- Incident response plans with IRS-specific details

- Encryption key management data

- Any information whose unauthorized disclosure could harm taxpayers, IRS operations, or revenue collection

These data types must be safeguarded using the NIST SP 800-53 moderate baseline controls as specifically tailored by IRS Publication 4812, along with IRS-defined overlays and the confidentiality requirements of IRC § 6103.

With Lazarus Alliance as your IRS 4812 partner, you gain complete, end-to-end support—from gap assessments and System Security Plan development to continuous monitoring and independent annual validation—ensuring sustained compliance without the disruption and expense of conventional audit cycles.

For IRS 4812 services that reduce costs and leverage the number one-ranked IRS 4812 audit software platform, call +1 (888) 896-7580 to get started. — Michael Peters, CEO & Founder

Key IRS Publication 4812 Audit Requirements and NIST SP 800-53 Alignment

IRS Publication 4812, Contractor Security & Privacy Controls, establishes the mandatory managerial, operational, and technical security controls that contractors and subcontractors must implement when receiving, processing, storing, accessing, or transmitting Federal Tax Information (FTI) at contractor-owned or contractor-operated facilities.

Publication 4812 directly incorporates and tailors the NIST Special Publication 800-53 moderate baseline security controls, adding IRS-specific overlays to meet the confidentiality requirements of Internal Revenue Code (IRC) § 6103 and the broader safeguarding program.

Key sections of IRS Publication 4812 include:

- Section 1.0 – Introduction and Applicability

- Section 2.0 – Contractor Security and Privacy Responsibilities

- Section 3.0 – Security and Privacy Control Requirements (with detailed NIST 800-53 mapping)

- Section 4.0 – State of Security (SoS) Package and Annual Reporting Requirements

- Section 5.0 – Inspection and Independent Validation/Audit Requirements

- Section 6.0 – Incident Reporting and Response

- Section 7.0 – Secure Disposal of FTI

- Section 8.0 – Cloud and Third-Party Service Provider Requirements

- Appendices – Control catalog, SoS Questionnaire, Contractor Statement of Security Assurance (CSSA) template, and glossary

Lazarus Alliance specializes in IRS Publication 4812 compliance assessments and independent audits. Using our Proactive Cyber Security® methodology and Cybervisor™ continuous assurance platform, we apply a risk-based, top-down approach that drives efficiency, reduces audit fatigue, and delivers measurable evidence of ongoing compliance—ensuring contractors meet both NIST 800-53 and IRS-specific requirements without the disruption of traditional point-in-time audits.

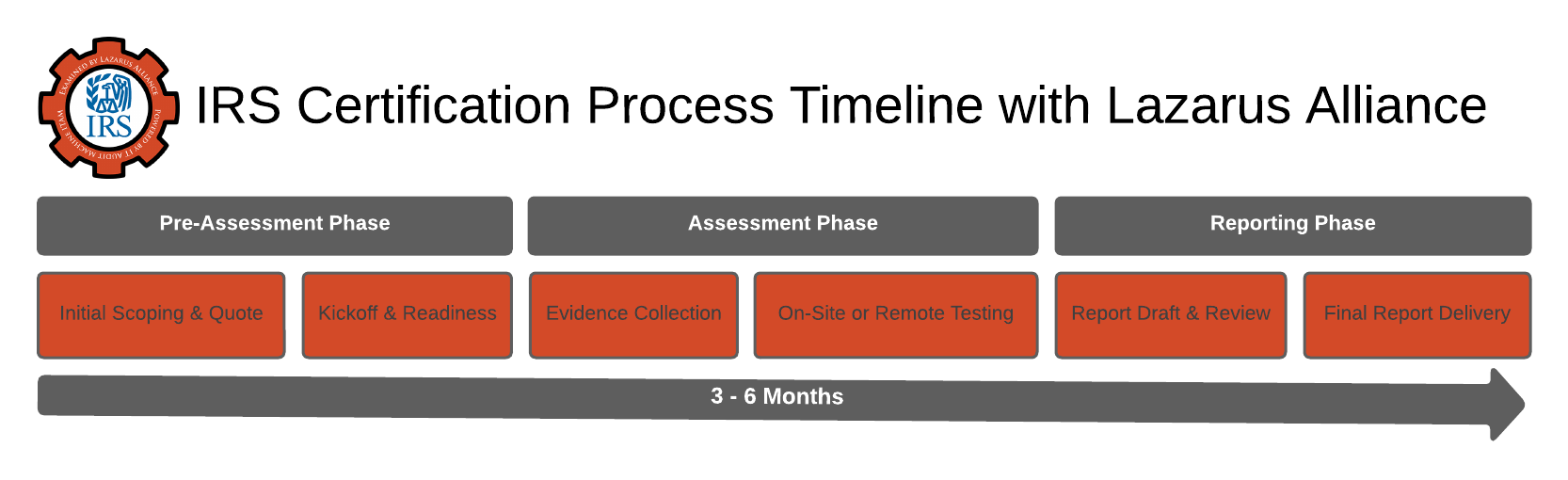

Basic IRS 4812 Audit Timeline – What to Expect with Lazarus Alliance

IRS Publication 4812 requires contractors and subcontractors handling Sensitive But Unclassified (SBU) data—such as Federal Tax Information (FTI) and Personally Identifiable Information (PII)—to demonstrate ongoing compliance through annual submissions and assessments. Unlike traditional point-in-time audits, Lazarus Alliance's Proactive Cyber Security® approach emphasizes continuous monitoring and risk-based validation, leveraging the Cybervisor™ platform to automate evidence collection and reduce overall assessment time by an average of 46%. This minimizes disruptions and ensures you're audit-ready year-round.

The timeline below outlines a typical IRS 4812 engagement with Lazarus Alliance, assuming a new or renewing contract of 12+ months (triggering the State of Security [SoS] package requirement). Timelines can vary based on your organization's size, readiness, and contract specifics—such as base periods or option exercises—but our methodology accelerates the process through automation and top-down risk prioritization. Annual cycles repeat every 12 months or per performance period, whichever is shorter.

Key Phases and Estimated Durations

Use this as a high-level guide—actual times can be shortened with tools like automated platforms such as Continuum GRC (e.g., reducing overall effort by up to 46%).

| Phase | Activities | Duration | Who's Involved | Key Deliverables |

|---|---|---|---|---|

| 1. Initial Engagement & Scoping | - Free consultation call to review contract scope, data flows, and current controls. - Gap analysis scoping: Assess existing System Security Plan (SSP), policies, and NIST SP 800-53 alignment. - Fixed-price proposal and kickoff planning, including access to the secure Continuum GRC SaaS portal for 24/7 collaboration. | 1–5 business days | Your team + Lazarus Alliance Cybervisor™ | - Scoping report with prioritized risks. - Customized roadmap and proposal. |

| 2. Preparation & Readiness Assessment | - Develop/automate core SoS components: Contractor Statement of Security Assurance (CSSA), SoS Questionnaire, and SSP. - Conduct initial vulnerability scans, penetration testing, and control maturity review (e.g., access controls, audit logging, encryption). - Optional remediation workshops to address gaps, with real-time evidence tracking via Cybervisor™ consultations. | 2–4 weeks | Your IT/security team + Lazarus Alliance auditors | - Draft SoS package. - Gap remediation plan (POA&M) with milestones. - Automated policy/procedure templates. |

| 3. Full Assessment & Validation | - Independent audit: Test controls against IRS 4812-tailored NIST SP 800-53 moderate baseline (e.g., audit/accountability, incident response, media protection). - On-site/virtual inspections, interviews, and evidence validation. - Continuous monitoring setup for ongoing compliance (e.g., automated logging and alerts). | 4–6 weeks | Your full operations team + Lazarus Alliance (A2LA-accredited assessors) | - Detailed audit report with findings. - Validated SoS package ready for IRS submission. - Evidence artifacts for IRS review. |

| 4. Submission & IRS Review | - Finalize and submit the SoS package to the IRS Contracting Officer's Representative (COR). - Respond to any IRS queries or requests for additional evidence. - If issues arise, develop a Corrective Action Plan (CAP) within 30–45 days. | 1–2 weeks (submission); 4–8 weeks (IRS review) | Your compliance lead + IRS COR (Lazarus supports responses) | - Submitted SoS package. - CAP (if needed) with progress tracking. |

| 5. Ongoing Continuous Assurance | - Quarterly Cybervisor™ check-ins for risk intelligence, remediation tracking, and updates. - Annual internal self-audit simulation to prep for potential IRS follow-ups or random external audits. - Adapt to changes (e.g., new threats, contract mods) with proactive alerts. | Ongoing (monthly/quarterly touchpoints) | Your team + Lazarus Alliance support | - Real-time compliance dashboard. - Annual refresh of the SoS package. - Incident response support as needed. |

What Sets Lazarus Alliance Apart in the Timeline

- Efficiency Gains: Our risk-based, top-down methodology focuses on high-impact controls first, avoiding "audit anarchy" from reactive prep. Clients often complete assessments 46% faster than traditional methods.

- Proactive vs. Reactive: While IRS may conduct periodic or random external audits (e.g., post-award follow-ups), we build in continuous validation to eliminate surprises—ensuring you're always submission-ready.

- Total Cycle Time: For a full annual cycle, expect 3–4 months from kickoff to submission, with seamless ongoing support thereafter. Shorter for renewals with maintained documentation.

- Risks if Delayed: Late SoS submissions can lead to contract holds, penalties, or termination. Our approach prevents this by embedding compliance into daily operations.

Frequently Asked Questions

What are IRS 4812 audit services, and what do they cover?

IRS 4812 audit services, based on IRS Publication 4812, help contractors and subcontractors identify and implement security requirements for handling IRS information. They focus on securing Sensitive But Unclassified (SBU) information, including taxpayer returns, Personally Identifiable Information (PII), and other sensitive data like IT system configurations. These controls are derived from NIST SP 800-53 standards to minimize risks in contractor-managed facilities.

Who needs IRS 4812 audit services?

These services are required for IRS contractors and subcontractors who possess, access, handle, or process Federal information or systems under a contract with the IRS. This includes any personnel or organizations responsible for IRS data at contractor facilities, particularly for contracts lasting 12 months or more.

What is the State of Security (SoS) package, and what does it include?

The SoS package is a mandatory submission for qualifying contracts, due every 12 months or per performance period. It consists of three main components: the Contractor Statement of Security Assurance (CSSA), the SoS Questionnaire, and the System Security Plan. These documents demonstrate compliance with security controls for IRS information.

How does Lazarus Alliance’s approach to IRS 4812 audits differ from traditional methods?

Lazarus Alliance uses a Proactive Cyber Security® framework with a continuous audit approach via Cybervisor™ consultations, rather than reactive end-of-period audits. This risk-based, top-down method includes ongoing support for documentation, vulnerability testing, and automation, reducing "Audit Anarchy" and ensuring proactive compliance.

What benefits can businesses expect from Lazarus Alliance’s IRS 4812 services?

Clients benefit from cost-effective, innovative solutions that minimize performance and operational risks. Key advantages include a 46% average reduction in assessment time through automation, improved efficiency via a risk-based approach, and access to industry-leading tools like the Continuum GRC SaaS portal for 24/7 collaboration.

What accreditation does Lazarus Alliance hold for these services?

Lazarus Alliance is accredited by A2LA under ISO/IEC 17020 (certification number 3822.01) for impartial assessments. This ensures credible, reliable IRS 4812, FISMA, and NIST-based evaluations, emphasizing a "Trust But Verify" philosophy.

How can I get started with IRS 4812 audit services from Lazarus Alliance?

Contact Lazarus Alliance at +1 (888) 896-7580 to discuss your needs. They offer comprehensive support, including initial consultations, documentation development, and technology reviews. You can also download their company brochure from the website for more details.

What happens if my organization fails an IRS 4812 audit or does not meet the required security controls?

Failure to comply with IRS Publication 4812 requirements can result in serious consequences, including contract termination, financial penalties, loss of eligibility for future IRS contracts, and potential referral to the IRS Office of Inspector General. Non-compliant contractors may also be required to immediately cease handling IRS data until corrective actions are verified. Lazarus Alliance helps prevent these outcomes by identifying gaps early, providing remediation roadmaps, and delivering continuous evidence of compliance throughout the contract lifecycle.

Credentials You Can Count On

American Association for Laboratory Accreditation (A2LA) ISO/IEC 17020 accredited certification number 3822.01.

Talk with one of our experts

Our Lazarus Alliance Cybervisor™ teams have experience performing thousands of assessments for organisations providing services to clients around the world.

We're here to answer any questions you may have.

Benefits of IRS 4812 Compliance

Why achieving and maintaining IRS Publication 4812 compliance is a strategic advantage — not just a contractual obligation.

| Benefit | Description | Business Impact |

|---|---|---|

| Preserve and Win IRS Contracts | Full compliance with IRS 4812 is a non-negotiable condition of award and continuation for any contract involving Federal Tax Information (FTI) at contractor facilities. | Avoid contract termination, stop-work orders, or debarment from future IRS opportunities. |

| Avoid Severe Financial & Legal Penalties | Unauthorized disclosure of FTI violates IRC § 6103 and can trigger civil penalties, criminal prosecution, and repayment of all contract funds received. | Protects your organization from multimillion-dollar fines and personal liability for executives and employees. |

| Streamlined Annual State of Security (SoS) Submissions | A mature, continuously monitored program (like the one Lazarus Alliance delivers) makes the annual CSSA, SoS Questionnaire, and SSP submission routine instead of a fire drill. | Saves hundreds of internal hours and eliminates last-minute overtime and consultant surge costs. |

| Reduced Audit Fatigue & Lower Assessment Costs | Proactive evidence collection and automation cut traditional audit time by an average of 46% (Lazarus Alliance client data). | Lower compliance spend year-over-year while improving control effectiveness. |

| Stronger Overall Cybersecurity Posture | IRS 4812 enforces the NIST SP 800-53 moderate baseline plus IRS-specific overlays — one of the most rigorous federal control sets outside of classified systems. | You inherit best-practice controls in access management, encryption, incident response, vulnerability management, and supply-chain risk — benefiting all customers, not just the IRS. |

| Competitive Differentiation | Demonstrated IRS 4812 compliance signals to commercial and other federal clients that you treat sensitive data with the highest care. | Win more bids (especially FedRAMP, CMMC, state tax, and healthcare contracts) by showcasing an existing high-bar compliance program. |

| Faster Onboarding of Subcontractors | A well-documented, continuously validated program lets you quickly bring subcontractors into scope without delaying contract start dates. | Improves cash flow and project timelines. |

| Real-Time Risk Visibility | Tools like Cybervisor™ and Continuum GRC provide dashboards and automated alerts instead of waiting for an annual audit to discover gaps. | Fix issues before they become findings, breaches, or IRS reportable incidents. |

| Protection of Reputation & Brand | A single FTI breach can generate headlines, loss of trust, and long-term revenue damage. | Compliance = proactive protection of taxpayer data = preservation of your reputation as a responsible steward. |

| Future-Proofing for Evolving Requirements | IRS continues to tighten controls (cloud requirements, zero-trust alignment, supply-chain mandates). An agile, continuous program adapts without major rework. | Stay ahead of coming changes instead of scrambling when new revisions to Pub 4812 or 1075 are released. |

In short: IRS 4812 compliance is not just about checking a box for one agency — it is one of the most effective ways to build an enterprise-grade information security program that pays dividends across your entire business.