FTC Safeguards Rule Compliance Audit Services by Lazarus Alliance. Call +1 (888) 896-7580 today!

Table of Contents

Toggle

The FTC Safeguards Rule (officially the Standards for Safeguarding Customer Information) is a regulation under the Gramm-Leach-Bliley Act (GLBA) enforced by the Federal Trade Commission. It requires non-banking financial institutions to develop, implement, and maintain a comprehensive written information security program with administrative, technical, and physical safeguards to protect the security, confidentiality, and integrity of customer information.

Who It Applies To

It covers a broad range of "financial institutions" under FTC jurisdiction (not regulated by other agencies), including mortgage lenders/brokers, payday lenders, finance companies, check cashers, tax preparers, credit counselors, debt collectors, motor vehicle dealers, and certain investment advisors or finders—essentially any business engaging in financial activities involving customer personal data.

Key Requirements

Covered entities must:

- Designate a qualified individual to oversee the program.

- Conduct regular risk assessments.

- Implement safeguards like access controls, encryption, multi-factor authentication, secure development practices, and incident response plans.

- Regularly test and monitor safeguards (e.g., penetration testing and vulnerability scans).

- Train employees and oversee service providers/vendors.

- Report annually to the board or senior management.

Updates

The Rule took effect in 2003, was significantly amended in 2021 (with most changes effective by 2023) to provide more specific guidance aligned with modern threats, and was further updated in 2023 to require notification to the FTC within 30 days of discovering a security breach involving unencrypted customer information of 500 or more consumers (effective May 2024).

Compliance helps protect against data breaches, avoids hefty penalties, and builds customer trust. Small institutions with data on fewer than 5,000 consumers may have limited exemptions from some provisions. For the full text, visit the FTC's website.

Working with Lazarus Alliance

Lazarus Alliance is a specialized cybersecurity and compliance firm focused on Proactive Cyber Security®, helping non-banking financial institutions (and organizations across industries) achieve, maintain, and demonstrate compliance with regulations like the FTC Safeguards Rule under the Gramm-Leach-Bliley Act (GLBA). Partnering with them provides expert guidance, efficient processes, and long-term risk reduction without the need for large internal teams.

How Lazarus Alliance Helps with FTC Safeguards Rule Compliance

- Expert-Led Audits and Assessments: Our certified professionals (e.g., CISSP, CISA) conduct comprehensive risk assessments, vulnerability scans, penetration testing, and control reviews (access controls, encryption, MFA, incident response). They map findings directly to Rule requirements and deliver clear reports with prioritized remediation roadmaps.

- Structured, Efficient Timeline: A typical engagement spans 9–15 weeks for the initial audit (kickoff, gathering, testing, reporting), with optional remediation (4–12 weeks) and ongoing monitoring. Much of the work is remote and collaborative, minimizing disruption—faster if your team is prepared.

- End-to-End Program Development: We assist in designating or providing a Qualified Individual, developing/updating your written information security program (WISP), creating policies/procedures, implementing safeguards, training employees, and overseeing vendors.

- Ongoing Support: Subscription-based services for annual reviews, updates due to business changes or threats, board reporting, and continuous monitoring to keep you compliant year-round.

Core Benefits of Partnering with Lazarus Alliance

- Avoid Penalties and Reduce Risks: Stay ahead of FTC enforcement (fines up to $100,000+ per violation) and breach notification requirements while significantly lowering breach likelihood and impact through proactive measures.

- Cost-Effective and Scalable: Affordable for small to large organizations; no need for full-time hires (e.g., interim CISO or vCISO services). Their tools (like automated platforms) and templates streamline processes.

- Alignment with Broader Standards: Services integrate with NIST, HIPAA, SOC 2, and others, reducing redundancy across multiple regulations.

- Builds Trust and Resilience: Enhances customer confidence, strengthens vendor management, improves internal processes, and fosters a security-focused culture.

- Proven Expertise: A2LA-accredited, veteran-owned firm with 25+ years of experience and thousands of global assessments. Clients praise their transparency, innovation, and value-driven results.

Working with Lazarus Alliance transforms the FTC Safeguards Rule compliance from a burden into a strategic advantage, delivering peace of mind, stronger security, and operational efficiency through expert partnership. Many clients report achieving compliance ahead of schedule and maintaining it cost-effectively. If you're a mortgage lender, tax preparer, fintech, or similar entity, they tailor solutions to your specific needs.

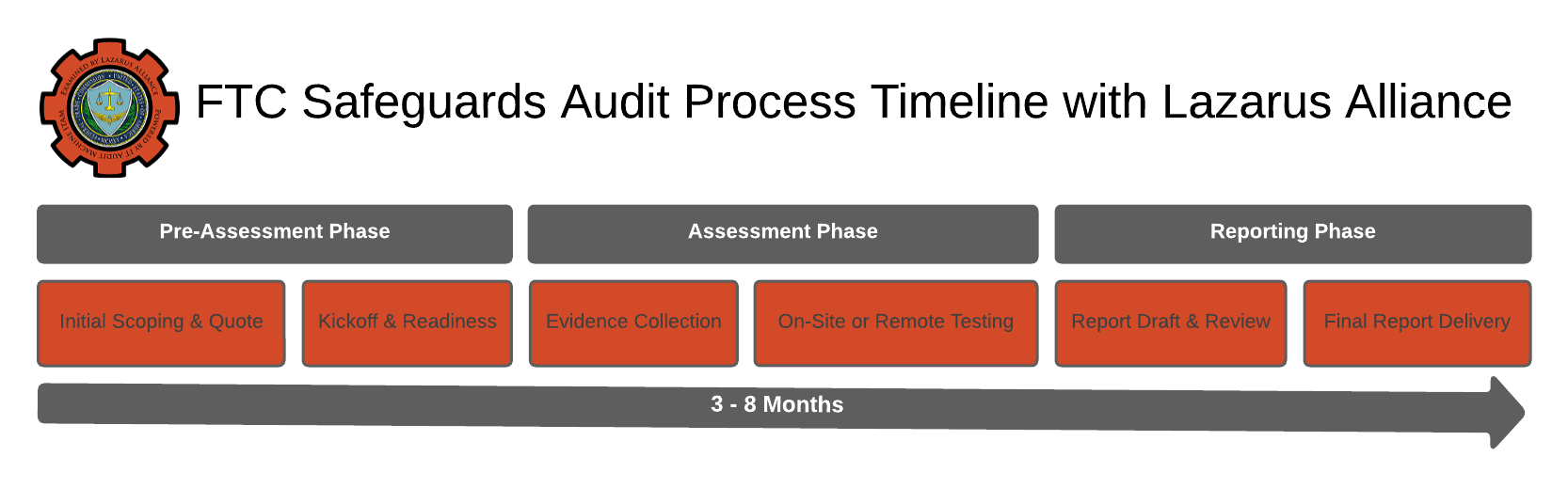

Basic FTC Safeguards Rule Audit Timeline with Lazarus Alliance

Lazarus Alliance offers a structured, efficient approach to FTC Safeguards Rule compliance audits and assessments. The timeline below represents a typical engagement for a mid-sized non-banking financial institution (e.g., mortgage broker, fintech, or tax preparation firm). Actual durations can vary based on organization size, complexity, existing documentation, and readiness.

| Phase | Key Activities | Responsible Parties | Typical Duration | Deliverables |

|---|---|---|---|---|

| 1. Engagement & Kickoff | - Sign engagement letter/NDA - Initial scoping call - Assign Lazarus Alliance team (lead assessor, Qualified Individual if needed) - Gather preliminary documents (org chart, data flows, existing policies) | Client + Lazarus Alliance | 1–2 weeks | Project plan, data request list, kickoff meeting notes |

| 2. Information Gathering & Readiness Assessment | - Complete Lazarus Alliance Safeguards Rule questionnaire - Provide network diagrams, asset inventory, prior risk assessments - Introductory interviews with key staff (IT, compliance, executives) | Primarily Client (supported by Lazarus Alliance) | 2–4 weeks | Completed questionnaires, document repository, gap analysis preview |

| 3. Risk Assessment & On-Site/Remote Testing | - Conduct comprehensive risk assessment - Review access controls, encryption, MFA, incident response plans - Perform vulnerability scans and penetration testing (if in scope) - Test employee training effectiveness and vendor oversight processes - Interview process owners | Lazarus Alliance (with Client assistance) | 4–6 weeks | Draft risk assessment report, testing evidence, findings log |

| 4. Report Development & Management Review | - Compile findings and recommendations - Map gaps to specific Safeguards Rule requirements (16 CFR § 314) - Prioritize remediation items (high/medium/low) - Present draft report to management and board (as required by the Rule) | Lazarus Alliance | 2–3 weeks | Final FTC Safeguards Rule compliance report, executive summary, and remediation roadmap |

| 5. Remediation Support (Optional) | - Assist with policy writing, control implementation, or training - Re-test remediated items - Update written information security program (WISP) | Lazarus Alliance + Client | 4–12 weeks (varies) | Updated policies, evidence of control implementation, and sign-off on remediation |

| 6. Ongoing Monitoring & Annual Requirements (Optional Ongoing Service) | - Annual report to board - Continuous monitoring or periodic reassessments - Support for required annual Qualified Individual reporting | Lazarus Alliance (as vCISO or monitoring service) | Ongoing (annual review typically 2–4 weeks) | Annual compliance attestation, updated risk assessment, and board presentation materials |

Total Typical Timeline for Initial Audit

- Standard engagement (Phases 1–4): 9–15 weeks from kickoff to final report

- With full remediation support: 4–8 months to reach full compliance

Lazarus Alliance designs the process to be collaborative and minimally disruptive, often completing much of the work remotely. Early preparation (having basic policies and inventories ready) can significantly shorten the timeline. Contact Lazarus Alliance for a customized proposal based on your organization’s specific needs and current maturity level.

Frequently Asked Questions

What is the FTC Safeguards Rule?

The FTC Safeguards Rule requires non-banking financial institutions (e.g., mortgage lenders, payday lenders, tax preparers) to develop, implement, and maintain a comprehensive information security program. This includes designating a qualified individual to oversee it, conducting risk assessments, and implementing safeguards like encryption and access controls to protect customer financial information.

Who must comply with the FTC Safeguards Rule?

Compliance applies to any business considered a "financial institution" under the Gramm-Leach-Bliley Act, such as those involved in financial activities like lending, debt collection, or financial advising. Lazarus Alliance helps identify if your organization qualifies and tailors compliance strategies accordingly.

How does Lazarus Alliance assist with FTC Safeguards Rule compliance?

Lazarus Alliance provides expert consulting, including risk assessments, policy development, and ongoing monitoring. Their certified experts (e.g., CISSP, CISA) guide you through building a safeguards program, ensuring it meets FTC standards while integrating with existing cybersecurity frameworks like NIST.

What are the key components of a Safeguards Rule information security program?

Core elements include: (1) a written program approved by senior management, (2) risk identification and assessment, (3) safeguards design and implementation, (4) regular testing and monitoring, (5) employee training, and (6) vendor oversight. Lazarus Alliance streamlines this with templates and automated tools for efficient rollout.

What are the penalties for non-compliance with the FTC Safeguards Rule?

Violations can result in civil penalties up to $100,000 per violation, consumer redress, and injunctive relief. In severe cases, like data breaches, it could lead to FTC enforcement actions. Partnering with Lazarus Alliance minimizes risks through proactive audits and incident response planning.

How often should organizations update their Safeguards Rule program?

The program must be reviewed and updated annually, or more frequently if there's a material change in business operations, technology, or threats. Lazarus Alliance offers subscription-based monitoring services to automate updates and ensure continuous compliance.

Can Lazarus Alliance help with third-party vendor management under the Rule?

Yes, the Rule requires evaluating and monitoring service providers handling customer data. Lazarus Alliance conducts vendor risk assessments, contract reviews, and ongoing audits to ensure your partners meet safeguards standards, reducing your liability.

What role does the designated “Qualified Individual” play, and how can Lazarus Alliance support this?

The Qualified Individual oversees the security program, reports to the board, and ensures objective assessments. If your organization lacks an internal expert, Lazarus Alliance can provide or train a qualified professional, including interim CISO services, to fulfill this requirement without full-time hires.

Credentials You Can Count On

American Association for Laboratory Accreditation (A2LA) ISO/IEC 17020 accredited certification number 3822.01.

Talk with one of our experts

Our Lazarus Alliance Cybervisor™ teams have experience performing thousands of assessments for organisations providing services to clients around the world.

We're here to answer any questions you may have.

Benefits of FTC Safeguards Rule Compliance

Complying with the FTC Safeguards Rule (part of the Gramm-Leach-Bliley Act) offers significant advantages for non-banking financial institutions and related businesses. While the primary goal is to protect customer financial information through a comprehensive information security program, compliance delivers tangible benefits beyond mere regulatory obligation.

- Avoids Severe Penalties and Enforcement Actions: Non-compliance can lead to civil penalties of up to $100,000 (adjusted for inflation) per violation, consumer redress, lawsuits, and even injunctive relief from the FTC. Full compliance eliminates these financial and legal risks.

- Reduces the Risk and Impact of Data Breaches: The Rule requires risk assessments, access controls, encryption, multi-factor authentication, employee training, and regular testing. These measures significantly lower the likelihood of breaches and limit damage if one occurs, helping prevent costly incidents that critically affect many small businesses.

- Builds Customer Trust and Enhances Reputation: Demonstrating a commitment to safeguarding sensitive financial data reassures customers, leading to stronger relationships, loyalty, and a competitive edge in industries where privacy is paramount (e.g., lending, tax preparation, or financial advising).

- Provides a Clear Framework for Strong Cybersecurity: The updated Rule offers concrete guidance on best practices, making it easier for businesses—especially smaller ones—to implement effective security without starting from scratch. It aligns with core data security principles and can serve as a foundation for "reasonable security" in other contexts.

- Improves Alignment with Other Regulations: Many requirements overlap with standards like NIST, parts of GLBA, or state laws, so compliance often helps meet multiple obligations efficiently and reduces redundancy in security efforts.

- Strengthens Vendor and Third-Party Risk Management: The Rule mandates oversight of service providers, ensuring partners handle data responsibly. This protects your business from downstream vulnerabilities and liabilities.

- Promotes Better Internal Processes and Resilience: Regular risk assessments, change management, incident response planning, and board reporting foster a culture of security awareness, improve operational efficiency, and make your organization more adaptable to evolving threats.

- Supports Long-Term Business Sustainability: In an era of increasing cyber threats, proactive compliance is an investment in survival—many businesses don't recover from major breaches. It also positions your company as responsible and forward-thinking to regulators, partners, and investors.

Overall, while compliance requires upfront effort, it leads to a more secure, trustworthy, and resilient operation that can save money and prevent crises in the long run. Partnering with experts (like Lazarus Alliance) can further streamline the process and maximize these benefits.