IRS 1075 & FISMA Compliance Audit Services by Lazarus Alliance. Call +1 (888) 896-7580 today!

Table of Contents

Toggle

To sustain a tax system rooted in voluntary compliance, the American public must have absolute confidence that the highly sensitive personal and financial information entrusted to the Internal Revenue Service (IRS) is rigorously protected from unauthorized access, use, inspection, or disclosure. IRS Publication 1075 establishes the authoritative framework of policies, practices, technical controls, and administrative safeguards that all recipient organizations—federal, state, and local agencies, contractors, subcontractors, agents, and any entity receiving Federal Tax Information (FTI)—must implement and maintain to safeguard this data.

Federal Tax Information (FTI) is broadly defined by the IRS under 26 U.S.C. § 6103 as any federal tax return or return information received directly from the IRS or obtained from a secondary source that originally received it from the IRS. This includes, but is not limited to, taxpayer identities, income details, payment history, audit records, and any derivative data that could identify a taxpayer.

Tax Information Security Guidelines for Federal, State, and Local Agencies: Safeguards for Protecting Federal Tax Returns and Return Information (IRS Publication 1075)

The IRS Office of Safeguards mandates that every organization handling FTI conduct comprehensive annual internal risk assessments and maintain continuous monitoring of safeguarding controls throughout the year. These ongoing evaluations are not optional—they are explicit contractual and statutory requirements. A properly executed IRS 1075 assessment provides far more than mere compliance checkbox validation; it delivers actionable intelligence on your organization’s true security posture, identifies latent vulnerabilities before they can be exploited, and ensures you are never blindsided by adverse findings during an official IRS Safeguards Review or onsite inspection.

Lazarus Alliance delivers Proactive Cyber Security® services specifically engineered to streamline and strengthen IRS 1075 compliance while dramatically reducing performance, operational, and financial risk. Our industry-leading approach combines:

- A2LA-accredited (ISO/IEC 17020) audit methodology

- Top-ranked, automated IT audit and compliance platform (ITAM SaaS) that cuts traditional assessment timelines by up to 46%

- Deep mapping of all IRS 1075 controls to NIST SP 800-53 Rev 5

- Continuous Cybervisor™ advisory support for year-round readiness

- Rapid, accurate preparation and automation of the mandatory Safeguards Security Report (SSR)

- Integrated vulnerability scanning, penetration testing, and remediation planning tailored to FTI environments

By partnering with Lazarus Alliance, organizations transform IRS 1075 compliance from a costly annual burden into a proactive, risk-based program that strengthens overall security posture, minimizes audit fatigue, avoids penalties, and ensures uninterrupted access to critical FTI data streams.

Don’t wait for an IRS Safeguards Review to reveal gaps—take control of your compliance destiny today with a proven, innovative leader in IRS 1075 audit and advisory services.

For IRS 1075 services that reduce costs and leverage the number one ranked IRS 1075 audit software platform, call +1 (888) 896-7580 to get started. — Michael Peters, CEO & Founder

Key IRS Publication 1075 Audit Requirements and NIST 800-53 Alignment

Publication 1075, Tax Information Security Guidelines for Federal, State, and Local Agencies and Entities, provides very detailed audit requirements. Publication 1075 documents the managerial, operational, and technical security controls that must be implemented as a condition of receipt of FTI. IRS has mapped the IRS Publication 1075 control requirements to the National Institute of Standards and Technology (NIST) control requirements (NIST SP 800-53). IRS Publication 1075 has the following key Sections:

- Section 1.0, Introduction

- Section 2.0, Federal Tax Information and Reviews

- Section 3.0, Record Keeping Requirement

- Section 4.0, Secure Storage

- Section 5.0, Restricting Access

- Section 6.0, Other Safeguards

- Section 7.0, Reporting Requirements

- Section 8.0, Disposing of FTI

- Section 9.0, Computer System Security

Lazarus Alliance specializes in the assessment of IRS Publication 1075 programs that align with this IRS publication. We apply a risk-based, top-down approach that drives both efficiency and effectiveness into the programs.

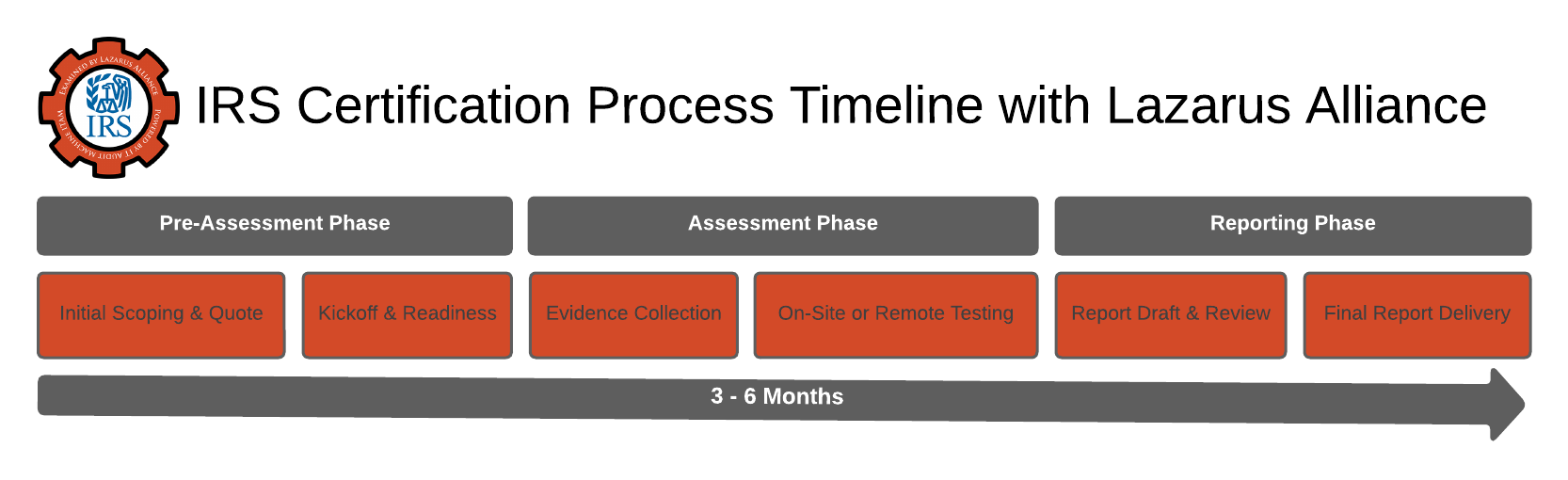

Basic IRS 1075 Audit Timeline – What to Expect with Lazarus Alliance

IRS Publication 1075 mandates a structured approach to auditing and compliance for organizations handling Federal Tax Information (FTI). The process emphasizes annual internal audits, continuous monitoring, and periodic external Safeguards Reviews by the IRS Office of Safeguards. These ensure ongoing protection of FTI through risk assessments, control evaluations, and reporting.

Timelines vary by organization size and complexity but follow a risk-based framework aligned with NIST SP 800-53. Below is a basic phased timeline for a typical internal IRS 1075 audit, drawing from official requirements. This assumes a proactive, annual cycle; external IRS reviews occur every 3 years (or randomly) and may overlap.

Key Phases and Estimated Durations

Use this as a high-level guide—actual times can be shortened with tools like automated platforms such as Continuum GRC (e.g., reducing overall effort by up to 46%).

| Phase | Description | Key Activities | Estimated Duration | Frequency/Deadline |

|---|---|---|---|---|

| 1. Preparation & Planning | Scope the audit, assemble the team, and gather initial documentation. Align with System Security Plan (SSP) and prior findings. | - Risk assessment kickoff - Control selection (managerial, operational, technical) - Notify stakeholders (e.g., 45 days prior for contractor disclosures) | 2-4 weeks | Annually (start Q1 or before FTI receipt) |

| 2. Data Collection & Evidence Gathering | Collect artifacts to verify controls (e.g., access logs, policies). | - Interviews with personnel - Document reviews (e.g., POA&M updates) - Vulnerability scans and log analysis | 4-6 weeks | Ongoing, but intensive during audit window |

| 3. Testing & Evaluation | Assess control effectiveness through testing. | - Penetration testing (if due) - Control assessments (independent assessor) - Identify weaknesses and draft POA&M items | 4-8 weeks | Annually, penetration tests are conducted every 3 years |

| 4. Reporting & Remediation Planning | Compile findings and develop action plans. | - Draft Safeguards Security Report (SSR) - Categorize risks (e.g., Critical requires 7-day mitigation plan) - Submit Corrective Action Plan (CAP) if needed | 2-4 weeks | SSR: Annually via IRS Secure Data Transfer (SDT); CAP: Within 30-45 days of findings |

| 5. Review & Submission | Finalize and submit reports; conduct management review. | - MOT (Management, Operational, Technical) Assessment - SSR submission with 3-year inspection plan | 1-2 weeks | SSR due annually (e.g., by fiscal year-end); retain records 5 years |

| 6. Continuous Monitoring & Follow-Up | Implement POA&M items and monitor post-audit. | - Quarterly POA&M updates - Weekly audit log reviews - Semi-annual CAP progress reports | Ongoing (1-3 months post-audit for initial fixes) | Continuous; full cycle repeats annually |

This timeline promotes proactive compliance, avoiding surprises during IRS reviews. For the full Pub 1075 details, reference the January 2023 revision (or later updates).

Frequently Asked Questions

What is IRS Publication 1075?

IRS Publication 1075 is a set of guidelines issued by the Internal Revenue Service (IRS) to protect Federal Tax Information (FTI). FTI includes any tax returns or return information from the IRS or secondary sources. The publication ensures the confidentiality, integrity, and availability of this sensitive data to promote voluntary tax compliance and prevent unauthorized access, use, or disclosure.

Why do organizations need an IRS 1075 audit?

Organizations that receive, process, or store FTI—such as federal, state, local agencies, or contractors—are required by the IRS Office of Safeguards to conduct annual internal audits and continuous security evaluations. An IRS 1075 audit helps assess compliance with security controls, identify risks in your current posture, and avoid penalties or surprises during IRS reviews, ultimately minimizing operational disruptions.

What is Federal Tax Information (FTI)?

FTI refers to any information related to tax returns or taxpayer data obtained directly from the IRS (primary source) or from another entity that received it from the IRS (secondary source). This includes personal and financial details that must be safeguarded under strict IRS rules to maintain public trust in the tax system.

How does Lazarus Alliance support IRS 1075 compliance?

Lazarus Alliance provides specialized IRS 1075 audit services, including assessments of managerial, operational, and technical controls mapped to NIST SP 800-53. Their Proactive Cyber Security® approach includes Cybervisor™ consultations for ongoing support, development of Safeguards Security Reports (SSR), vulnerability testing, and use of their top-ranked audit software platform to streamline compliance.

What is a Safeguards Security Report (SSR), and why is it important?

An SSR is a required document that summarizes an organization's compliance with IRS 1075 safeguards, including details on security controls, risks, and remediation plans. It's essential for IRS reviews and annual reporting. Lazarus Alliance automates SSR preparation through its ITAM SaaS portal, ensuring accuracy and efficiency while meeting A2LA ISO/IEC 17020 accreditation standards.

How long does an IRS 1075 audit typically take with Lazarus Alliance?

Using their innovative ITAM SaaS portal and risk-based methodology, Lazarus Alliance reduces traditional assessment time by 46%, allowing for start-to-finish completion in record time. Exact timelines depend on your organization's size and complexity, but the 24/7 accessible platform enables faster data collection and reporting compared to manual processes.

What makes Lazarus Alliance’s approach to IRS 1075 audits unique?

Unlike reactive audits, Lazarus Alliance emphasizes a proactive, continuous monitoring model with Cybervisor™ consultations. They're A2LA ISO/IEC 17020 accredited (certification #3822.01), leverage industry-leading software for cost savings, and focus on top-down risk assessments by experienced IT, financial, and operational experts, ensuring thorough NIST 800-53 alignment without unnecessary overhead.

Who should consider IRS 1075 audit services from Lazarus Alliance?

These services are ideal for federal, state, and local government agencies, contractors, or any entity handling FTI that must comply with IRS 1075, FISMA, and NIST standards. They're suitable for organizations of all sizes seeking efficient, innovative solutions to reduce compliance costs and risks.

Credentials You Can Count On

American Association for Laboratory Accreditation (A2LA) ISO/IEC 17020 accredited certification number 3822.01.

Talk with one of our experts

Our Lazarus Alliance Cybervisor™ teams have experience performing thousands of assessments for organisations providing services to clients around the world.

We're here to answer any questions you may have.

Benefits of IRS 1075 Compliance

Achieving and maintaining full IRS 1075 compliance delivers far-reaching advantages that go well beyond simply “checking a box.” Here are the primary benefits organizations realize:

| # | Benefit | Detailed Impact |

|---|---|---|

| 1 | Uninterrupted Access to Federal Tax Information (FTI) | Non-compliance can trigger immediate suspension of FTI feeds by the IRS. Full compliance guarantees continued receipt of critical taxpayer data required for programs (e.g., Medicaid, child support enforcement, tax administration, debt collection). |

| 2 | Avoidance of Severe Penalties and Sanctions | Violations of 26 U.S.C. § 6103 can result in criminal penalties (fines up to $5,000 and/or 5 years imprisonment), civil penalties, and loss of future FTI access. Compliance eliminates this exposure. |

| 3 | Stronger Overall Cybersecurity Posture | IRS 1075 mandates implementation and testing of ~320+ NIST SP 800-53 Rev 5 moderate-baseline controls. Meeting these raises your security maturity across the board, reducing the risk of breaches unrelated to FTI. |

| 4 | Reduced Risk of Data Breaches and Reputational Damage | Robust safeguards (encryption, access controls, logging, incident response) directly lower the likelihood and impact of incidents involving highly sensitive taxpayer data. |

| 5 | Successful Passage of IRS Safeguards Reviews | Proactive internal audits and continuous monitoring virtually eliminate surprise findings during the IRS Office of Safeguards’ triennial (or unannounced) onsite reviews. |

| 6 | Lower Long-Term Compliance Costs | A mature, automated, and continuously monitored program reduces audit fatigue, shortens assessment timelines (often by 40-50%), and minimizes expensive last-minute remediation efforts. |

| 7 | Improved Operational Resilience | Requirements for contingency planning, incident response, and regular testing translate into better business continuity and disaster recovery capabilities. |

| 8 | Enhanced Stakeholder and Public Trust | Demonstrating rigorous protection of taxpayer data strengthens relationships with federal partners, state legislatures, oversight bodies, and the public you serve. |

| 9 | Eligibility for Federal Contracts and Funding | Many federal and state programs explicitly require IRS 1075 compliance as a prerequisite for contracts or grant funding involving FTI. |

| 10 | Streamlined Audits for Overlapping Frameworks | Controls implemented for IRS 1075 heavily overlap with FISMA, HIPAA, CJIS, SOC 2, and FedRAMP, reducing effort and cost when pursuing multiple certifications. |

Bottom-Line Summary

IRS 1075 compliance is not just a regulatory obligation—it is one of the most effective ways to protect sensitive taxpayer data, avoid catastrophic penalties, strengthen enterprise-wide security, and ensure your organization can continue delivering mission-critical services without interruption.

Organizations that treat IRS 1075 as a strategic security investment rather than a compliance burden consistently emerge more secure, resilient, and cost-efficient.